What is a 1031 Exchange?

Need to do a Like-Kind Exchange/ 1031?

Imagine this: One of your clients is a property owner of an apartment complex that has been in their portfolio for years. The property has risen from the original price of $8 Million to $100 Million. While you already manage their securities portfolio, they want to know what their options are for making the most of their investment and defer capital gains tax. Everyone wants to sell property for more than they bought it for! That’s where you and the a 1031 exchange come in.

Why manage 1031s for your clients?

Since you and your clients have already established a positive relationship through your current advisory services, it makes perfect sense to include their real estate investments in your services as well. Not only will you have a more complete picture of their assets, you will be able to provide advice and expertise across all of their investments. You become a united front, with the the tools and resources to offer your clients a complete and clear picture of their portfolio.

1031 Benefits:

This is where many financial advisors ask “What is a 1031 exchange?” While the name of the exchange process comes from the IRS form, these are also known as a “Like-Kind Exchange.”

For your client with the apartment complex, a 1031 exchange would bring valuable funds back into the investment playing field. Additionally, if your client planned to pass on their investments to their children, this provides the oppourtunity to transfer the original cost basis of the property while still providing their heirs a stepped up basis at death.

A section 1031 exchange is a popular and efficient offering to defer capital gains and provide portfolio diversity. Entering a 1031 exchange serves to fulfill a number of business and/or investment objectives including:

- Potential preservation of equity

- Potential to maximize the outcome on investment

- Leverage for larger properties

- Potential diversification

- Management relief

- Estate planning

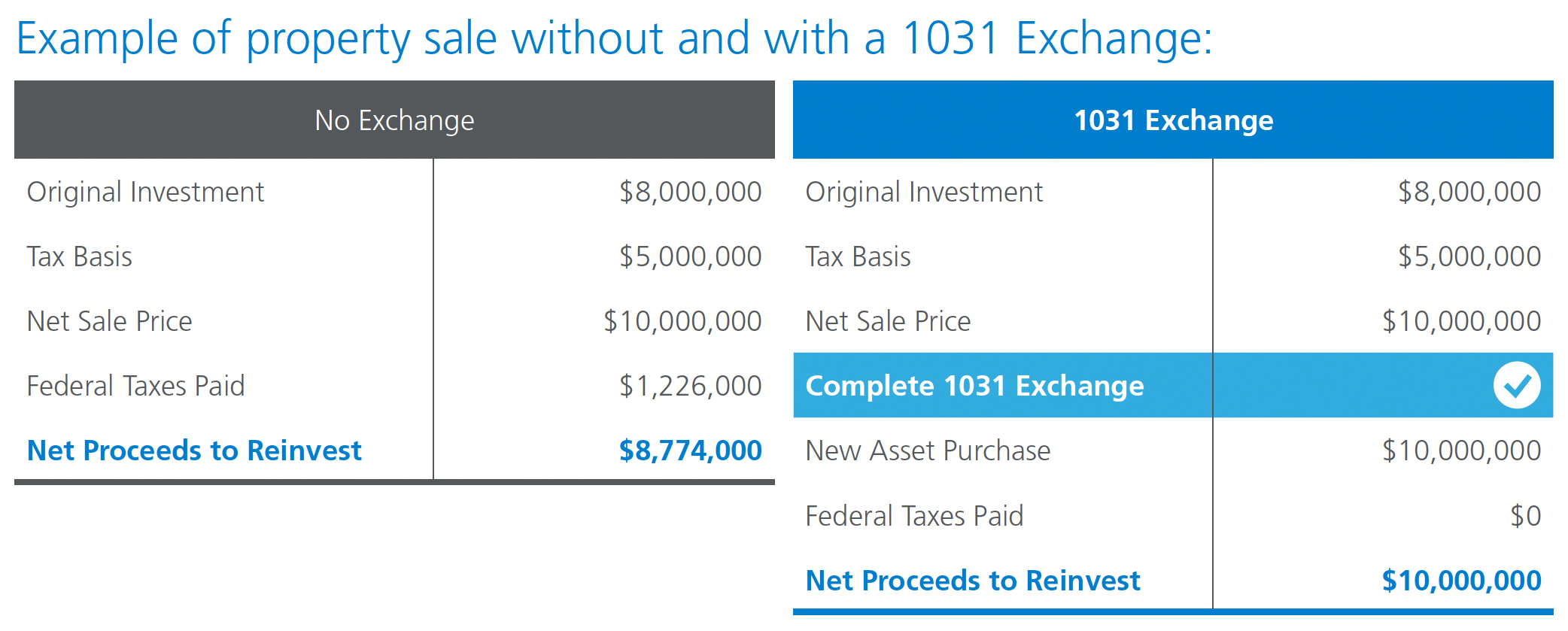

Consider the following scenario for your client:

This is a very basic example used for illustrative purposes only. The actual calculations of tax liabilities can be much more complicated and we advise property owners consult with their tax attorney, accountant and/or tax consultant when calculating their tax liabilities. Some of the key assumptions include, but are not limited to: i) Applied unrecaptured Section 1250 gain tax rate of 25%; ii) applied long-term federal capital gains tax rate of 20%; iii) no State income tax applied to the tax calculation since this varies based on location; and iv) net sales price includes any closing costs. For a list of all assumptions applied to this illustrative example please contact us.

This example is for illustration purposes only and is not an actual transaction.

1031 Considerations:

Going back to the client with the apartment complex to sell, there are a few important considerations for executing a 1031 exchange. Utilizing a 1031 Exchange Service will alleviate many of the timeline concerns, but the following factors need to be taken into consideration:

Before Selling Relinquished Property

Properly draft purchase and sale agreement of relinquished property. Select a Qualified Intermediary and enter into an Exchange Agreement.

Identification Period (45 days)

45 days from sale of property to identify potential replacement property(s). Identify a maximum of three (3) replacement properties, without regard to the fair market value of the properties. Outline the replacement assets in writing to the Qualified Intermediary.

Total Exchange Period (180 days)

Closing of identified replacement asset must occur before the earlier of: i) 180 days from closing of the relinquished property; or ii) tax filing date, including extension. Qualified Intermediary will close the replacement property and transfer to the Investor. After closing Investor must complete and file Form 8824 with IRS.

Closing:

After successfully executing a 1031 exchange for your apartment complex-owning client, your client is now the proud property owner of an up and coming coastal multi-use property. If passed on through your clients’ inheritance, their beneficiaries will likely continue to see the value of the 1031 exchange, long after the transaction is complete.

Once you begin managing your clients’ commercial real estate investments, you can’t help but see the benefits across the field – for both client and advisor.